4.1 Cost planning and cost accounting

| Site: | FHM Online University |

| Course: | Company Foundation (MOVIDIS) |

| Book: | 4.1 Cost planning and cost accounting |

| Printed by: | , Gast |

| Date: | Saturday, 28 February 2026, 12:52 AM |

Introduction

After learning a lot about the market, competition, marketing & sales and sales forecasting in the previous study letter, you will now learn essentials about business accounting.

While the previous modules were crucial for documenting the marketability of your idea, it is now a matter of proving this with concrete figures and calculations. For this purpose, you will deal with the modules "Cost Planning & Cost Accounting", "Calculation & Pricing", "Financial Planning" and "Capital Requirements Calculation".

4.1 Cost planning and cost accounting

Cost planning and cost accounting should determine which costs and to what extent costs will be incurred in the realisation of the business concept. Cost planning and cost accounting are the commercial core of a business idea, where it is decided whether a product, a service or a project can be economically implemented in the market. Cost planning is used to decide how the company can and may operate. Cost planning for a start-up will have a different degree of coverage than for a business succession or an operational business concept where the amount of many costs is already known. The cost planning must be structured in depth according to the requirements of the respective business concept.

4.1.1 Cost plans

Cost plans record all costs and expenses of service production from different contexts. The costs of developing a business idea must be recorded in the same way as the pre-financing of the creation of the products themselves. Capital requirements must be determined. Profit and loss must be calculated on a monthly basis. An entrepreneur must constantly know the liquidity. Final accounts are required at the end of the year. Cost accounting forms the basis for the following detailed accounts:

- the implementation of the calculation,

- the calculation of the investments,

- the calculation of the capital requirement,

- the calculation of profit and loss,

- the calculation of liquidity,

- the preparation of the balance sheet,

- the preparation of annual financial statements.

The calculation includes the determination of the costs; it is also required for a cost estimate.

Investing means investing capital profitably. Investment is defined as a medium to long-term capital investment.

The capital requirement for investments, purchase of goods, start-up financing, participations, etc. is to be calculated. The capital requirement is covered by equity capital and borrowed capital. Every company needs capital.

The profit and loss account (P&L) determines the annual result of the business activity. The annual result is obtained when all expenses (costs) are deducted from the sales revenue.

The liquidity calculation determines whether the company can always meet all payment obligations.

The balance sheet is the comparison of the company's assets and liabilities for a business year.

Annual accounts must be prepared at the end of the year. The annual financial statement of a company can vary in scope. It usually includes the profit and loss account, the liquidity statement and the balance sheet.

4.1.2 Cost and performance accounting

Cost and performance accounting is part of business accounting, which provides information on the assets, earnings and liquidity situation of the company.

Accounting

Accounts shall be kept of all operational data. The bookkeeping is a period accounting. It refers to the business year and records all income and expenditure.

Practitioners say: If you have your bookkeeping under control, you also have your business under control. Problems in the company and "sloppy" bookkeeping often go hand in hand. Proper bookkeeping provides information about the earnings situation and the financial situation of a company.

- All merchants and companies that operate a "commercial business" (Commercial Code HGB) are obliged to keep accounts. Non-merchants are also obliged to keep accounts if the company exceeds certain turnover figures. Corporations, such as the GmbH, are obliged to keep accounts and balance sheets. Double-entry bookkeeping is mandatory for them. Each transaction is recorded in an account and a contra account with a debit and credit side (account "salary" via account "bank").

- Non-traders" and "freelancers" are not obliged to keep accounts. They must prepare an income statement (simple bookkeeping). In all cases, the principles of proper accounting (GoB) apply. Everything must be documented. Receipts must be: complete, timely, correct, clearly arranged and properly recorded. No booking without an original receipt.

Operating expenses

Knowledge of the classification of business expenses is of general importance for the preparation of a business plan. The following definitions should help to name the costs correctly.

In commercial language, expenses, expenditures and costs are distinguished.

- Expenses include all cash outflows, e.g. payment of salaries, rent, etc.; operating expenses that are not expenses are, for example, depreciation or invoices that have not yet been paid.

- Expenses include the total use of goods for the services. They are divided into earmarked expenses and non-operating expenses. Earmarked expenses concern direct operating expenses such as rents, salaries, material costs, etc.; neutral expenses are, for example, non-operating expenses for donations.

- Costs include the use of goods for the production of goods and services, measured in money. Basic costs are, for example, material costs, wage costs, advertising costs; additional costs that are not matched by expenses are, for example, entrepreneurial wages, interest on equity capital.

All expenses that the company has to incur in order to be able to operate the business are summed up under operating expenses.

Imputed operating expenses

When planning operating expenses, a distinction must be made between imputed costs. Calculating them in a cost estimate, for example, are not recognised as operating expenses for tax purposes, however.

- Imputed costs are costs that are not matched by expenses. For tax purposes, for example, the repayment of loans, the personal private withdrawal (imputed entrepreneurial wage) or the rent for owner-occupied housing do not count as costs of the business.

- Imputed entrepreneurial income is defined for freelancers as private withdrawal for personal living expenses.

- Imputed interest for equity capital: It is intended to include a remuneration for the capital input by the entrepreneur or the shareholders in the cost accounting. Usual interest rates can be calculated.

- Imputed rent, e.g. when using an office in one's own home.

Direct and indirect costs

The question of the allocation of costs to the provision of services must be answered. Can the costs be directly assigned to an individual service or are they general, indirect costs that arise for the entire company without being (directly) assignable to an individual service?

- Direct costs can be directly attributed to the individual service or unit of service, e.g. production material, wages, material costs, fees....

- Indirect costs are also defined as overhead costs. They can be distributed to the cost centres of the respective activity unit with the help of a distribution key (e.g. operational accounting sheet). The costs can only be indirectly allocated to an individual service, e.g. salaries, depreciation (AfA), room costs, insurances...

Fixed costs , Variable costs

Fixed and variable costs differ in relation to the total costs of service provision. Costs are allocated according to the ratio of fixed to variable total costs.

- Constant, fixed costs arise regardless of the level of employment or utilisation, e.g. rent for business premises, interest, accounting staff, insurance....

- Variable, variable costs arise when the level of employment or utilisation increases or decreases; e.g. consumables related to the individual customer, customer frequency in a restaurant when eating and drinking...

4.1.3 Cost units, cost centres and cost types

Cost unit

Cost units are the units of activity (individual product or service) of an enterprise, such as an order, certain products, product groups, a project, a building application, an operation, a good.

Cost Object Controlling builds on Cost Element and Cost Centre Accounting and is used to determine the total costs for each cost object in an accounting period (Cost Object Time Accounting) or to determine the unit costs for each cost object (Cost Object Unit Accounting).

Cost unit accounting determines the cost price and the sales price of a product or an order (cost unit).

The purpose of cost unit accounting is to show what the costs are for.

Cost centre accounting

A distinction can be made between cost centres if the costs are to be allocated to individual service units such as jobs, departments, projects, processes or locations. The type of cost centre classification is to be defined by each company itself.

- Z. E.g. material costs for the production of a service at workstation A, B, C. - Cost centre is the workstation

- Z. E.g. manufacturing costs incurred at location A. - Cost centre is the location

- Z. E.g. distribution costs incurred in the dispatch department. The cost centre is the shipping department.

Cost-type accounting

Cost-type accounting records and determines costs according to their content. For clarity, certain costs can be grouped into operating costs in the business plan. The type of grouping is company-specific.

Costs are defined in terms of content below. Basic cost types are dealt with in detail elsewhere in the manual.

- Material costs : Raw materials, consumables, supplies, working materials and all material costs for the production of products and services;

- Raw materials are substances that enter the manufacturing process as main components in the product, e.g. wood in a joinery...;

- Operating materials are substances that do not enter into the product but are required in the execution of the manufacturing process, e.g. lubricants, fuel oil, paper);

- Auxiliary materials are substances that enter the product as by-products, e.g. glue, paint for furniture, paper for a concept);

- Purchased finished parts, are parts that are purchased from other manufacturers and installed in the company's own production, e.g. fittings for kitchens, EDP tools for EDP programmes);

- Personnel costs or labour costs: Wages and salaries (see personnel cost calculation module 3), fees, bonuses, allowances, royalties, statutory social security (see module 3), travel expenses, work clothing, insurance, company car, holiday pay, voluntary social benefits, direct insurance, staff training, continued payment of wages in the event of illness (e.g. 6 weeks by the employer, only then does the health insurance pay), severance pay, staff advertisements, etc...;

- Social security : Social security contributions are regulated by law. They are paid half by the employer and half by the employee. The amount changes several times a year in some cases. Contributions are levied up to the income threshold. This is the maximum amount of gross salary up to which contributions must be paid to the statutory social security system. Contributions are levied on the gross salary of the employee.

- Since the amount fluctuates annually, a personnel cost factor of 20 - 25 % on the employee's gross salary can be calculated in the business plan.

- Space costs: rent for offices, workshops, shops, restaurants, halls, etc., plus ancillary costs for energy, installations, cleaning, insurance, taxes, maintenance, vacancy periods, brokerage costs, etc. plus ancillary costs for energy, installations and alterations, cleaning, insurance, taxes, maintenance, vacancy periods, estate agent's fees, etc. The amount of ancillary costs may well be up to 50 % of the basic rent. Space costs in prime locations of cities are considerably more expensive than in peripheral or commercial areas. Rent indexes exist in various cities. When renting space costs, deposits of one to three months' rent are common. The deposit must be placed with the landlord in a special account. For a monthly rent of € 2,000 for a commercial space, a three-month deposit of € 6,000 may be required. This must be taken into account in the financing and capital requirements calculation.

- Marketing and advertising costs: (see Chapter 3) Administrative marketing costs, e.g. marketing manager's costs, sales planning costs; revenue-generating marketing costs, e.g. costs of advertising, marketing mix, logo design, sales promotion, public relations, sales force, brochures, etc. Turnover-realising marketing costs, e.g. costs of invoicing, packaging, delivery and order processing.

- Insurance does not insure the entrepreneurial risk, but only possible damage (property damage and personal injury) that may occur in a company or privately. (see Insurances)

- Accident insurance: All employees of a company are legally insured against accidents in the Berufsgenossenschaft (BG). The accident insurance contribution is determined by risk classes. Companies with a high risk pay more than others. Currently, the average contribution to the BG is 1.3 % of the gross wage in all sectors.

- Taxes are legally defined public charges on companies and individuals. (see taxes)

- Leasing : The cost of renting assets such as machinery, equipment, vehicles, etc. The leasing rates usually include capital financing by the lessor. Leasing is not an investment but a current operating expense. Thus, leasing does not consume equity or debt capital. Leasing can "preserve" liquidity.

- R&D: Costs for research & development, costs for scientists, institutes, products and services, expert opinions, projects, etc.

- Capital costs : interest, redemption, risk premiums, advice, etc.

- External service costs: transport costs, rents, energy costs, fees, etc.

- Overhead costs are overhead costs for overhead, administration, insurances, advertisements, fees, contributions, lawyer, auditor, hospitality, management, organisation, EDP, telephone, internet, communication, advance costs, etc.

4.1.4 Entrepreneurial wages

The entrepreneur's wage is one of the imputed costs. In the case of a partnership, it is intended to include remuneration for the work of the entrepreneurs working in the enterprise and their dependants in the cost accounting. Its amount is based on the remuneration for comparable work. According to its origin, it belongs to the additional costs, which are characterised by the fact that they are not offset by direct operating expenses.

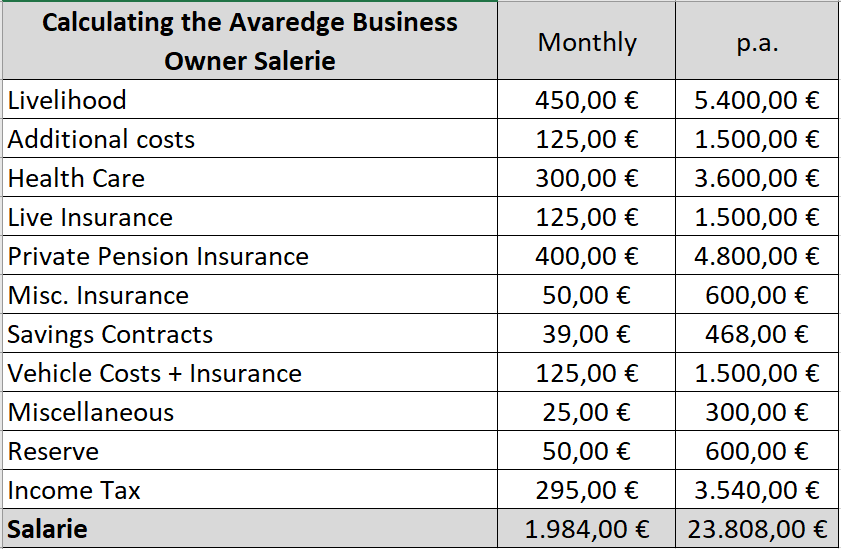

Table 2: Business Owner Salarie

The amount of the imputed entrepreneurial wage should at least cover the cost of living. They are to be determined individually within the framework of the business plan. The entrepreneur's wage is also referred to as the "private withdrawal" in the case of partnerships or freelancers. Care must be taken to ensure that the entrepreneur's wage remains appropriate to the business. What is appropriate certainly depends on the size and earning power of the business. The entrepreneur must determine his entrepreneurial wage or private withdrawal himself.

4.1.5 Depreciation cycle

Depreciation refers to the loss in value of company assets (fixed assets and current assets). Depreciation is abbreviated as AfA = Absetzung für Abnutzung. Depreciation is the imputed cost for the consumption or replacement of fixed assets such as machinery, equipment, IT, fixtures and fittings and other capitalisable goods.

The principle of depreciation is based on the fact that a company buys an investment item and can claim the purchase as operating expenses in subsequent years in a cost-effective manner within the framework of depreciation. The company must secure the capital for the purchase price through equity or debt capital.

While the acquisition and production costs must be paid in full immediately by the entrepreneur, the Afa can only be offset against a fraction of the costs in the P&L in subsequent years. The Afa thus stipulates that the costs for assets that are used in the business for more than one year must be allocated in equal or declining-balance annual amounts over the "normal useful life".

With the Afa, the assets are included in the depreciation cycle of the company. The aim is to be able to purchase the impaired goods again after the value has been consumed.

Stages of depreciation:

- The impairment of fixed assets is recognised through annual depreciation.

- Depreciation distributes the acquisition costs of an asset over its useful life (years).

- Depreciation reduces profit as an expense.

- Depreciation co-finances new investments, which is why it is taken into account in the calculation.

On the one hand, depreciation is a business method for determining the consumption of value; on the other hand, it is an instrument of tax assessment by the tax office. The state can increase or decrease its revenue from corporate taxes via the amount of depreciation. As a result, federal governments have changed the conditions for depreciation several times.

Linear depreciation

Under the Income Tax Act, the following depreciation rules currently apply.

- Low-value assets (GWG) can be depreciated up to a sum of € 150 in the year of acquisition; from € 150.01 to € 410 in the year of acquisition or fully depreciated according to ordinary useful life.

- Assets are depreciated on a straight-line basis over a certain depreciation period as a constant percentage of the acquisition or production cost of the asset.

- Useful life: e.g. computers 3 years, cars 6 years, office furniture 13 years, workshops and machinery up to 25 years.

- A fixed asset that can be used for three years is depreciated at 33 1/3% percent. The asset shall be listed in the fixed asset schedule.

E.G.: Linear depreciation of a computer over 3 years, acquisition costs € 2,000

|

Year |

Linear depreciation Years in %and € |

Residual value on 31.12.of the year |

|

Acquisition costs |

3 years |

2.000 € |

|

Depreciation in the 1st year |

33 1/3 % = 666,66 € |

1.333,34 € |

|

Depreciation in the 2nd year |

33 1/3 % = 666,66 € |

666,68 € |

|

Depreciation in the 3rd year |

33 1/3 % = 666,68 € |

0 € |

Degressive depreciation

In the case of declining balance depreciation, the depreciation rate is applied to the residual value of the asset. In this case, the depreciation rate may be 2 ½ times as high as with straight-line depreciation, but not higher than 25 % per year. The book value will never reach "zero" under this method. Therefore, it is possible to switch from declining balance to straight-line depreciation.

e.g. declining balance depreciation of office equipment, acquisition cost € 2,000, useful life 10 years

|

Year |

Degressive depreciation of the years in %. |

Residual value on 31.12.of the year |

|

Acquisition costs |

Max. 25 % per year |

2.000 € |

|

Depreciation in the 1st year |

25 % = 500 € |

1.500 € |

|

Depreciation in the 2nd year |

25 % = 375 € |

1.125 € |

|

Depreciation in the 3rd year |

25 % = 281,25 € |

843,75 € |

|

Depreciation from 4th year to 10, years |

Change to linear depreciation 843,75 € : 6 years = 140,62 € per year |

703,12 € |

|

Depreciation from 4th year annually |

140,62 € |

0 € in 10 year |

Principles of the Afa

Depreciation, as an operating expense, reduces a company's profit and thus its tax burden. By extending the useful life of an asset, the state can increase tax. In other words, the company invests and pays today, but only enjoys the full tax deduction of its costs in subsequent years (up to 25 years).

Depreciation is sometimes treated differently from a business point of view (from the point of view of the company) and from a tax point of view (from the point of view of the tax authorities). For example, a machine that has already been depreciated and is carried as fixed assets with a memo value of € 1. It can still provide full performance in the operational process without causing imputed costs. However, this no longer has any effect for tax purposes.

Depreciation in the business plan

1. It must be decided whether it is a depreciable asset.

2. Low-value assets are depreciated in the year of acquisition.

3. For all other assets, the useful life is to be determined from the tax office or tax advisor, if necessary. The total amount is to be determined by the useful life (on a monthly or annual basis). The depreciation tables of the tax office apply. (see also on the internet)

4. The depreciation amount is to be taken into account in the profit and loss account as imputed operating expenses. The depreciation increases the operating expenses and thus reduces the taxable profit.

5. The depreciation amount is to be taken into account in the price calculation as imputed consumption of value.

6. The depreciation amount must be taken into account in the liquidity planning. Since depreciation is assessed as imputed operating expenses and is included in the P&L, it increases liquidity when it is determined. Liquidity is increased by the amount of depreciation.

Depreciation is used as a cost in the calculation of sales prices. The calculated depreciation amounts flow back into the company in the form of liquid funds via the sales revenues. Therefore, depreciation must be added to revenues in the liquidity calculation. With the depreciation, acquisitions are made possible from depreciation returns. Depreciation is therefore also an important means of financing.

4.1.6 Insurances

Entrepreneurs must check which risks should be covered by insurance. The rule is

that an entrepreneurial risk is not insurable. As a self-employed person and

entrepreneur, the operational and personal risk must be insured. The risk is to

be held responsible for damage caused by accident, negligence, gross negligence

or even intent. As a rule, only accidental and negligent damage is insured.

Insurance cover is excluded if gross negligence or even intent is proven.

Business insurances are about damages that can occur, for example, due to theft, burst water pipes or negligence. In extreme cases, they can lead to the closure of the company. As a result, there could be failures in production or in the range of services, which has financial consequences. Company insurance also includes social security for employees, which the company has to finance.

With personal insurance, the loss of the individual's ability to perform is to be insured. It is often the most important capital. Especially in the first few years of setting up a business, a company is particularly dependent on the ability of the founder or owner to work. A sudden illness can endanger a business. The "greatest possible" risk should be insured.

The actual risks should be covered. Care should be taken to ensure that the costs remain reasonable. What is appropriate and necessary is to be determined in the concrete individual case.

When taking out insurance, it is important to find the right insurance provider. A price-performance comparison is relatively time-consuming, but should be taken into account. Contracts should have a reasonable (short) term and an annual cancellation option or contract extension.

Before taking out an insurance policy, information should be obtained from the industry or independent institutions such as the German Insurance Protection Association (DVS). Insurance companies provide calculations and costs of their insurances as offers. Price comparisons are absolutely necessary. Low insurance premiums and consistent loss prevention help save costs. Insurance companies grant premium discounts or refunds: e.g. for alarm, fire alarm, sprinkler or extinguishing systems; in case of non-claiming of insurance benefits.

Overview: Business insurances

Business liability insurance:

in the event of claims for damages by third parties, e.g. customers, suppliers,

visitors and employees.

Business interruption insurance (BU

insurance):

for running costs such as wages, salaries, rent and interest, etc., as long as

no income can be generated

Pecuniary loss insurance for company

directors:

for the personal liability of GmbH managing directors and AG board members in

particular.

Burglary insurance:

for damage due to theft, destruction, damage, etc.

Electronics insurance:

e.g. for costs of reusing programmes and re-entering data as well as

maintaining business operations after a virus attack.

Fire insurance:

by the owner for damage caused by fire, lightning strike, explosion or aircraft

crash

Motor vehicle liability insurance:

for damage to persons, property and assets caused by the driver to third

parties

Tap water insurance:

for damage caused by water leaking from water pipes or water or heating

systems.

Machinery insurance:

for repairs to stationary and mobile machinery caused by human error, operator

error, negligence, etc.

Product liability insurance:

for damages suffered by

third parties due to defective products (especially for manufacturers,

suppliers, licensees).

Storm insurance:

for storm damage to buildings and movable property

Environmental liability insurance:

for claims for damages if soil, water, air is polluted by the business.

Insurance for employees:

e.g. accident insurance, company pension insurance or new pension options

Fidelity

insurance:

for costs arising from embezzlement, misappropriation, theft, forgery, fraud

and other property offences

In addition to business insurance, entrepreneurs should insure themselves against personal risks. They can threaten the existence as a whole. This includes the

- Health insurance including family members and a daily sickness allowance to help alleviate loss of income,

- Accident insurance in the event that the entrepreneur is absent for a short or even long period (disability) due to an accident,

- Disability or occupational disability insurance in the event that the entrepreneur can no longer work at all or only partially.

- Life insurance to provide financial security for the family in the event of premature death,

- Old-age provision in the event of retirement. Various forms of investment are possible here. Investment in savings contracts, investment funds, real estate ownership, life insurance, private pension insurance.

4.1.7 Taxes

Taxes are monetary payments which the public community (Federal Government, Länder, municipalities) may levy by virtue of its financial sovereignty on legal or economic transactions or facts without direct consideration. Natural and legal persons are liable to pay taxes. For companies, the topic of taxes is a broad field that is constantly changing.

When it comes to taxes in the business plan, it is not important to be able to apply all tax laws. Even tax advisors find that difficult. In addition, the tax perspective is quite different from the business perspective that an entrepreneur must first take for a successful business. For this reason, this handbook is only intended to name the most important taxes so that they are known by name and type.

When used in the business plan, the calculation of taxes can be subordinated.

- This means, for example, that the turnover tax must be shown in the determination of revenues or sales, but it can be shown in the same amount in the operating expenses, which results in a "zero-sum game". In principle, turnover tax is a transitory item for which the company must pay on behalf of the state. In any case, it must be ensured that within the presentation in the business plan it is not possible to act once with and once without tax calculation; then the results would be erroneous in substance.

- Trade taxes, corporate income taxes or capital gains taxes are usually only due when the company makes a profit. In the business plan, many start-ups initially focus on making a profit in the first place. The business plan should therefore first deal with the planning of the business idea and the operative business. The tax treatment and evaluation with the help of the balance sheet, with provisions and loss carry-forwards or supplements can be done in a second step with the help of a tax advisor.

- When it comes to tax assessment, a tax advisor is usually unavoidable.

Taxes and legal form

The topic of taxation is of crucial importance even before the company is founded. The legal form determines taxation. Which legal form is best cannot be answered in general terms, but only on an individual basis, since facts such as liability play a role in the legal form.

The legal form determines the way in which "income statement" (e.g. non-traders, liberal professions), "profit and loss statement" (e.g. GmbH) or the preparation of a balance sheet (e.g. GmbH, AG) is drawn up.

The legal form also determines whether the founder has to register a business (trade licence) or conclude a GmbH contract with a notary. In addition, the GmbH is entered in the commercial register at the Chamber of Industry and Commerce. Different tax laws and requirements for proper accounting apply to all legal forms.

In the case of personal enterprises, a distinction can be made between traders and sole traders, i.e. entrepreneurs and persons in the liberal professions.

- A trader is a person who establishes a business and to whom the trade regulations such as the Trade, Commerce and Industry Regulation Act (Gewerbeordnung), the Catering Act (Gaststättengesetz) or the Handicrafts Code (Handwerksordnung) apply. Registration takes place at the trade/regulatory office of the city/municipality in whose district the business is located. As a partnership or corporation, a balance sheet must be prepared. The business can be entered in the commercial register at the local court.

- The liberal professions can operate without a trade licence. They must submit a personal tax return to the tax office of the place of residence. An income surplus account must be prepared. All business expenses and business income must be recorded. Own consumption must be recorded as private withdrawal (entrepreneur's salary).

The choice of legal form

The legal form determines tax issues. For example, about this,

- whether losses can be claimed,

- whether income tax can be saved,

- whether trade tax must be paid,

- whether running costs can be claimed as business expenses.

In principle, entrepreneurial losses can be claimed for tax purposes. Losses are offset against profits. As a rule, the remaining profit is taxable.

A distinction must be made between loss carry-forward and loss carry-back. Losses that often occur in the start-up phase can also be claimed retrospectively, e.g. in the case of a GbR or sole proprietorship. They can be offset against income from the previous year (loss carryback). If there are still losses, they can be carried forward to the next year.

There is an order of precedence for loss carry-forward. Losses from the current year may first be offset against income from the current year and only then against losses from previous years. Maximum taxable amounts apply.

Loss carry-back and also offsetting against current income are not possible in a GmbH. Losses can only be carried forward to the next year. For this reason, a GmbH is not always the best solution for a start-up that makes losses in the first year. If the founder has also paid himself a managing director's salary, he must pay wage tax on this, which would not have been incurred if a partnership had been founded.

Tax identification

All businesses must obtain a tax identity number from their relevant tax office (registered office of the business). Invoices without such a SIDNR are not permitted. In addition, all invoices must have a sequential invoice number. Non-compliance may result in fines and possibly penalties.