4.1 Cost planning and cost accounting

4.1 Cost planning and cost accounting

4.1.4 Entrepreneurial wages

The entrepreneur's wage is one of the imputed costs. In the case of a partnership, it is intended to include remuneration for the work of the entrepreneurs working in the enterprise and their dependants in the cost accounting. Its amount is based on the remuneration for comparable work. According to its origin, it belongs to the additional costs, which are characterised by the fact that they are not offset by direct operating expenses.

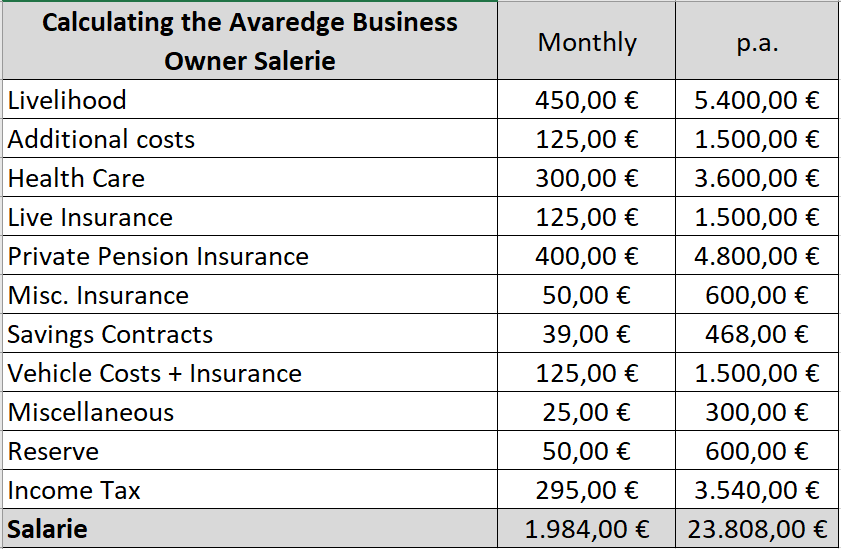

Table 2: Business Owner Salarie

The amount of the imputed entrepreneurial wage should at least cover the cost of living. They are to be determined individually within the framework of the business plan. The entrepreneur's wage is also referred to as the "private withdrawal" in the case of partnerships or freelancers. Care must be taken to ensure that the entrepreneur's wage remains appropriate to the business. What is appropriate certainly depends on the size and earning power of the business. The entrepreneur must determine his entrepreneurial wage or private withdrawal himself.